- DE |

- EN

Revolving funds, microcredits and crowdfunding - Connective Cities Dialogue Event

Overview

November 24-26, 2014 for the 3rd Connective Cities Dialogue Event to exchange on innovative financial instruments in urban development and housing policy.

Revolving Funds, Microcredits and other innovative financial instruments are relevant in urban development as well as in housing policy. They are of highest concern if no sufficient classical funding is available, where self-help approaches are to be strengthened and where unprofitable real estates are supposed to be brought back to the markets. Local actors from developing and emerging countries were asked to contribute to the Dialogue with their vast experience regarding instruments such as micro-credits, small scale support of housing and further innovative financing instruments.

The Dialogue’s event objective was to provide all participants with good insight to good practices in the field and to invite them on the other hand to contribute to the dialogue with their experience. Based on examples, the practitioners introduced during the workshop, the experts discussed challenges and needs for improving urban financing practice and governance.

Program

Draft Agenda 3rd Connective Cities Dialogue Event:

Leipzig: 24 - 26 November 2014

[pdf, 6 pp., 220 kb]

Keynotes

Exchange on good practices

The workshop was centred around case studies presented by the participating practitioners on the application of innovative financing solutions. The dialogue event focussed on two particular fields: (i) Community-based practices and financing schemes, that either a) create new markets or b) are supported by the user-involvement both social and economic dimensions. (ii) Institutional approaches that either supplement or pro-long urban development policies.

Presentations

Mietshäuser Syndikat (apartment-house syndicate), Germany

A network of 88 self-organized house projects and 26 project initiatives with a solidarity-based financing scheme. Michael Stellmacher, Mietshäuser Syndikat

Asian Coalition for Housing Rights, Thailand

ACHR is a coalition of Asian professionals, NGOs and community organizations working on housing rights campaigns, training and advisory programs, projects to promote community savings and community funds and citywide slum upgrading.

Tran Thi Minh Chau, ACHR

Centre for Community Initiatives / Kinondoni Municipality, Tanzania

Cooperation project bringing together civil society and a municipality on community funded housing schemes.

Adelaida Joyce Kagaruki, Kinondoni Municipality and Dr. Tim Ndezi, Centre for Community Initiatives

Holzmartk plus eG, Berlin, Deutschland

Holzmarkt is a cooperative network and grassroots initiative gathering expertise and capital for a bottom-up driven redevelopment of a riverbank site in Berlin. Anja Pilipenko, Holzmarkt plus eG

Montagstiftung Urban Räume, Krefeld, Germany

Redevelopment of a former weaving mill and creation of a revolving funding scheme for community work.

Marcus Paul, Montagstiftung Urbane Räume

National Confederation of Municipalities

Lessons and challenges of financing for housing in Brazil.

Tatiane de Jesus, National Confederation of Municipalities

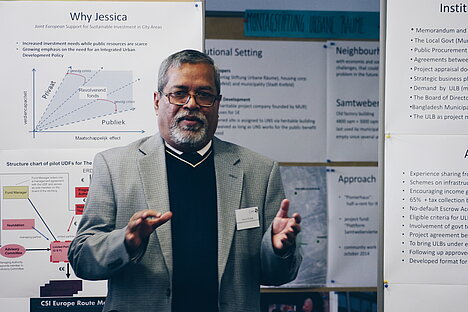

City of the Hague, Netherlands

The Hague’s Urban Development Fund and a European view on revolving funds.

Ton Overmeire, City of The Hague

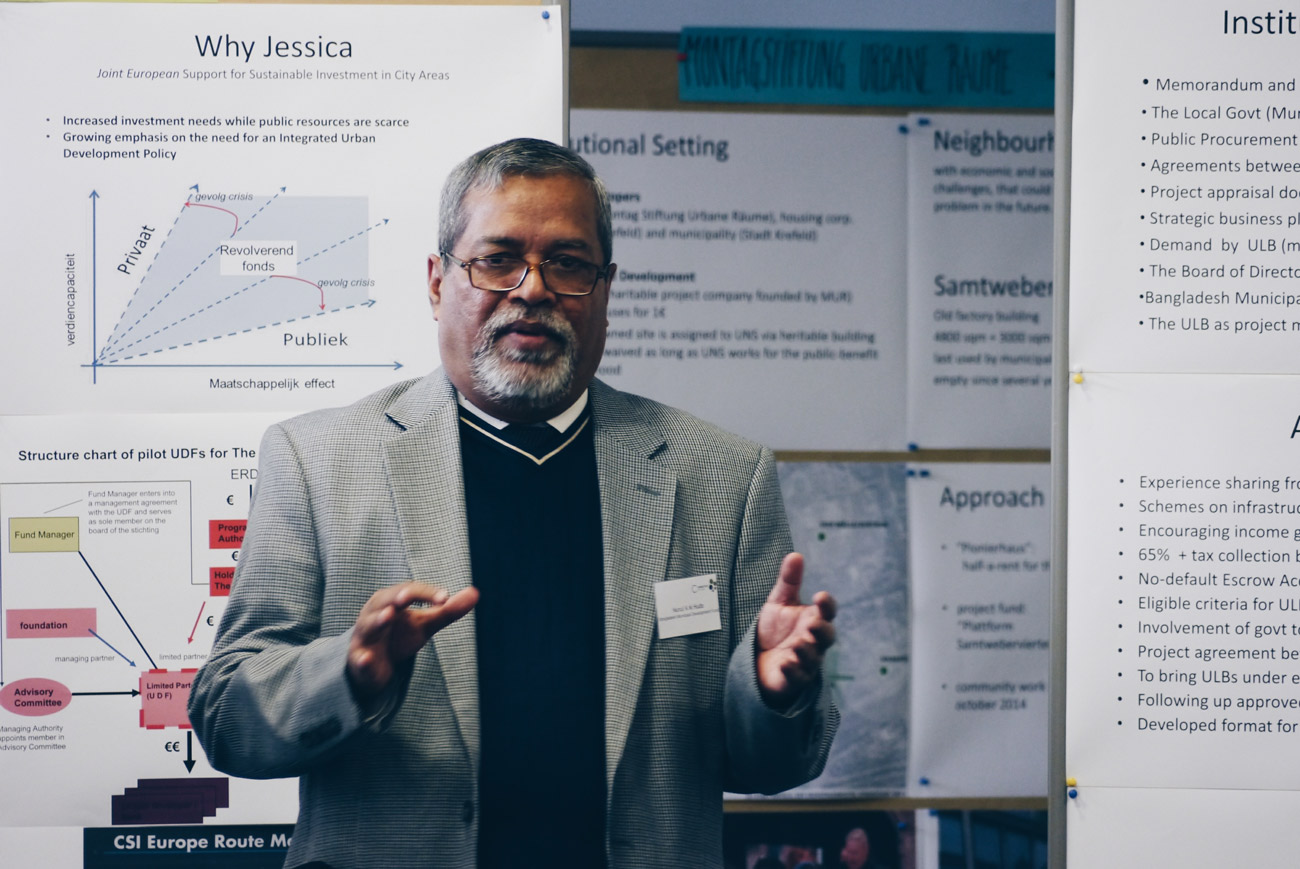

Dhaka, Bangladesh

The Bangladesh Municipal Development Fund (BMDF) is a revolving fund and has been transformed into a financial intermediary for the municipalities to borrow money for investment under the urban development program.

K. M Nurul Huda, Bangladesh Municipal Development Fund (BMDF)

Results

Innovative financing instruments have to overcome a number of governance and structural boundaries. Both grass-root community projects as well as public institutions in e.g. revolving funds are subjected to external conditions that require reducing transactions costs in terms of (i) educating on the financial innovation theme at stake and (ii) developing projects subjected to external success criteria and structural requirements.

The following themes have been identified as important follow-up themes:

Implementation of revolving funds: How to implement local revolving funds using different kinds of financial resources (local budgets, international donors and others)? What new legislative structures are needed?

Capacity building: Development of expertise in matters of investment management, development of integral approaches for urban practitioners

Information management and user orientation: Development of methods and tools that involve local users and provide insights required for decision analysis

The workshop concluded that innovative financing instruments are subjected to a variety of success factors that only can be addressed by stakeholders that are acting as cross-sector intermediaries: They have to interface between new format of participation through financial instruments as well as provide moderation in community-centred dialogues.

Field trip

Participants had the opportunity to visit the (apartment-house syndicate) project Kunterbunte 19, a co-housing project financed within the Miethäuser Syndikat system. On a larger scale the urban development in Leipzig West and the different Leipzig different participatory housing projects were presented and discussed during the field trips.

Report

Connective Cities Dialogue Event

<link file:1205 download internal link in current>Innovative financial instruments in urban development and housing policy

24 – 26 November 2014 in Leipzig, Germany

[pdf, 12 pp., 1,2 mb]